The Evolving Economics of Space Tourism: A Decade Ahead

The space tourism industry is rapidly evolving, transitioning from an exclusive luxury to a growing sector with broader accessibility, driven by significant advancements and increasing investment[13]. This market, which was estimated at USD 888.3 million in 2023, is projected to reach USD 10.09 billion by 2030, growing at a compound annual growth rate (CAGR) of 44.8% from 2024 to 2030[4]. Another forecast estimates the market to reach USD 5.1 billion by 2035, with a CAGR of 10.4% from 2025 to 2035[1]. The global space tourism industry is also estimated to be valued at USD 1.58 billion in 2025 and is expected to reach USD 4.88 billion by 2032, exhibiting a CAGR of 17.5% from 2025 to 2032[5]. These projections highlight a significant economic expansion, with the broader space economy expected to reach $1 trillion by 2040[12].

Launch Cost Dynamics

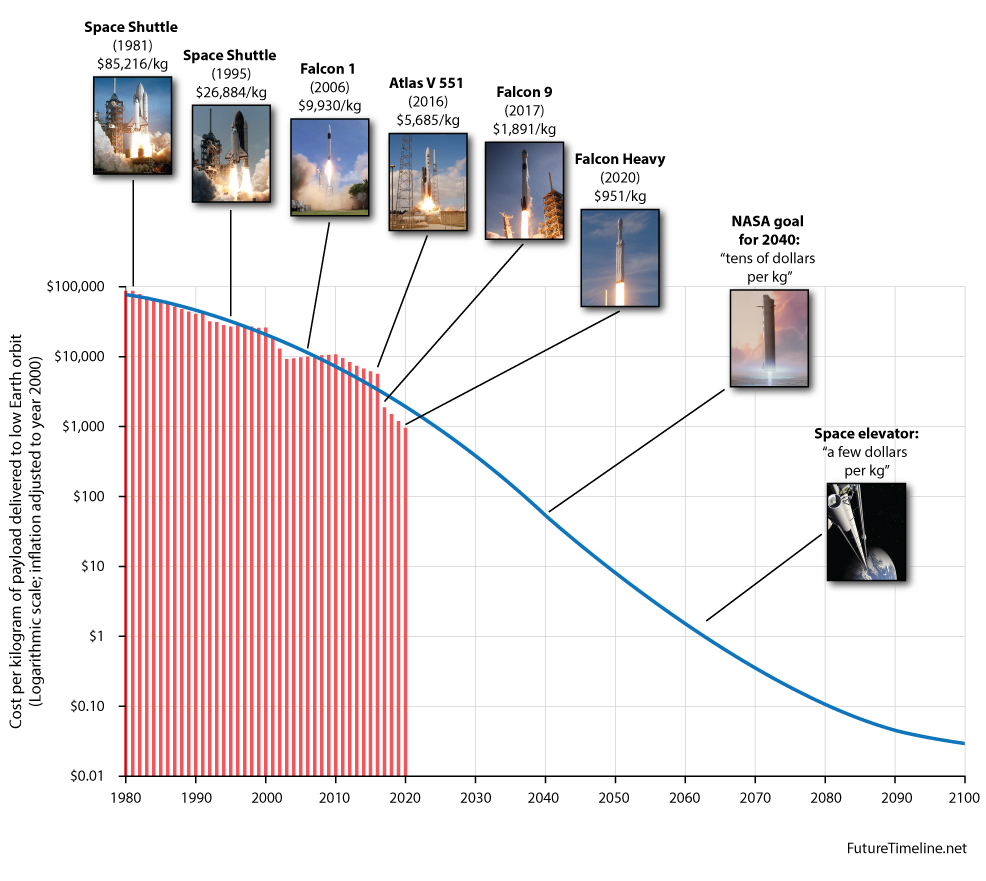

A primary economic driver in space tourism is the substantial reduction in launch costs, making space travel more viable and cost-effective[4]. Commercial launch systems have dramatically lowered these costs; for instance, SpaceX's Falcon 9 advertises a cost of $2,720 per kilogram to Low Earth Orbit (LEO), a factor of 20 reduction compared to NASA's Space Shuttle, which cost about $54,500 per kilogram[2]. While the Space Shuttle cost an average of $1.6 billion per flight, or nearly $30,000 per pound of payload to LEO, SpaceX's Falcon 9 charges around $67 million per launch, or about $1,200 per pound of payload to LEO[7]. This competitive market, fostered by new commercial launch providers like SpaceX and Rocket Lab, has driven down prices[7]. The ability to reuse rockets, a focus for companies like SpaceX and Blue Origin, is steadily decreasing flight costs[13]. Virgin Galactic has also reduced its ticket price to $450,000, with expectations of further reductions as operations scale up[13].

Supply Chain and Infrastructure Development

The growth of space tourism is fueling significant developments in its supply chain and infrastructure. Demand for commercial space stations is increasing, with companies like Axiom Space developing habitable modules that could eventually replace the International Space Station (ISS)[13]. New spaceports are adapting worldwide, including facilities in the U.S., UAE, and Europe, to accommodate more commercial flights[13]. Indirect suppliers play a crucial role, offering services such as infrastructure construction, spaceport operations (like New Mexico's Spaceport America for Virgin Galactic), astronaut training facilities, and luxury accommodations and transportation for high-net-worth clients[1]. The space economy, estimated at approximately $450 billion, incorporates infrastructure like satellite and rocket production, distribution networks connecting cosmic systems, and applications that support enterprises reliant on orbital systems[12]. The miniaturization of microprocessors and other satellite components has also helped private space companies get off the ground[7].

Insurance and Liability Frameworks

Insuring space tourism presents unique challenges due to a lack of historical data and uniform regulation[11]. Unlike traditional space insurance, which focuses on physical assets like satellites, space tourism brings the human element to the forefront, requiring a different risk assessment[11]. Currently, passengers typically sign a waiver of liability, assuming full risk themselves, serving as a temporary solution until the insurance market can provide comprehensive coverage[12]. There are concerns about "Black Hole Risk," where existing policies may not explicitly exclude space exposures, creating ambiguity[12]. Regulators like the FAA require commercial launches to have third-party liability and government property damage insurance[12]. However, the 2004 Commercial Space Amendments Act excludes regulation of onboard passengers, instead requiring informed consent and a signed waiver of liability[12]. The limited data on space tourism flights makes underwriting and pricing difficult, as insurers might only have a few launches to base their risk analysis on, compared to the hundreds of thousands of flights in aviation[11]. Companies must establish clear policies for handling emergency scenarios, refunds, and liability in the event of technical failures or medical incidents during flights[13]. NASA also plans to require private astronauts to buy life insurance[12].

Customer Base and Accessibility

The customer base for space tourism is expanding beyond billionaires to include high-net-worth individuals and corporate-sponsored travelers[13]. As costs decline, more businesses are exploring space travel as an incentive or promotional opportunity[13]. Future plans include subscription-based programs or financing options to make space experiences available to a broader audience[13]. Motivations for customers include experiencing something unique, seeing the view of Earth from space, and learning more about the world[8]. While space travel is becoming more accessible, it remains a niche product with few direct competitors[4]. For example, Virgin Galactic offers tickets for as low as USD 45,000, aiming to make space travel accessible to the general consumer[1]. However, only 43% of Americans expressed interest in going into space in a 2018 survey[8].

Emerging Secondary Industries

The booming space tourism market is investigating unique means to provide a greater experience in space, leading to the emergence of secondary industries like orbital hospitality[1]. Space hotels and orbital resorts, which once sounded futuristic, are now underway, with companies like Orbital Assembly Corporation and Axiom Space aiming to provide luxury orbital stays[13][1]. Orion Span, for instance, planned to deploy a private commercial space station, the Aurora Space Station, to serve as a space hotel, accommodating up to six tourists at a time for 12 days at a price of $9.5 million[4][8]. These facilities are expected to offer high-end dining, specialized spacewalks, and spectacular views of Earth[1]. Beyond hospitality, the entertainment industry is also capitalizing on space tourism, with future plans including space-based concerts, films shot in microgravity, and live broadcasts from orbit[13]. Microgravity research and space manufacturing, such as the production of fiber optics and pharmaceuticals, are also gaining attention, with the space tourism sector indirectly contributing by increasing demand for commercial space access[13].

Regulatory Landscape and Environmental Considerations

As the space tourism industry grows, regulators like the FAA are implementing stricter safety guidelines for commercial spaceflights, requiring rigorous testing and enhanced training programs[13]. However, the existing regulatory frameworks are often underdeveloped or untested, making it difficult for space tourism companies to obtain licenses, which can lead to flight delays and increased costs[11]. There is a need for global cooperation to establish new traffic management systems to prevent orbital congestion and ensure safe space travel for all stakeholders[13]. Environmental concerns are also emerging with the increasing frequency of launches. Studies indicate that soot emissions from rocket launches have a significant heating effect on the atmosphere and can deplete the ozone layer[4]. For example, a 2010 study simulated the impact of 1,000 suborbital launches, calculating the release of 600 tonnes of black carbon into the stratosphere, which could lead to temperature changes and ozone depletion[8]. Researchers stress that substantial effects from routine space tourism should motivate regulation[8]. Companies are researching greener propulsion systems and exploring carbon offset programs to reduce the environmental impact of space tourism[13].

Get more accurate answers with Super Pandi, upload files, personalized discovery feed, save searches and contribute to the PandiPedia.

Let's look at alternatives:

- Modify the query.

- Start a new thread.

- Remove sources (if manually added).

:max_bytes(150000):strip_icc()/space-travel-costs-infographic-SPACETOURISMHERE0821-2000-d132f1faad384795ae80cbff663ff027.jpg)