Developing a personal budget is an essential step towards achieving financial stability and meeting your economic goals. A well-structured budget provides a clear picture of income and expenses, enabling individuals to make informed decisions about spending and saving. Here’s a comprehensive guide on how to create a personal budget that works.

Understanding the Basics of Budgeting

What is a Budget?

A budget is a financial plan that outlines how much money is available to you and how it will be allocated to various expenses and savings over a specific time frame, typically a month. It is crucial to understand that budgeting is not restrictive; rather, it's a tool for financial freedom that helps manage your money effectively[1][2].

Why is Budgeting Important?

Budgeting helps individuals regain control over their finances, minimize stress, and work towards their financial goals. It allows for careful planning of necessary expenses while also accommodating savings and discretionary spending[9]. A solid budget also contributes to better financial decision-making, which can reduce anxiety related to money management[9].

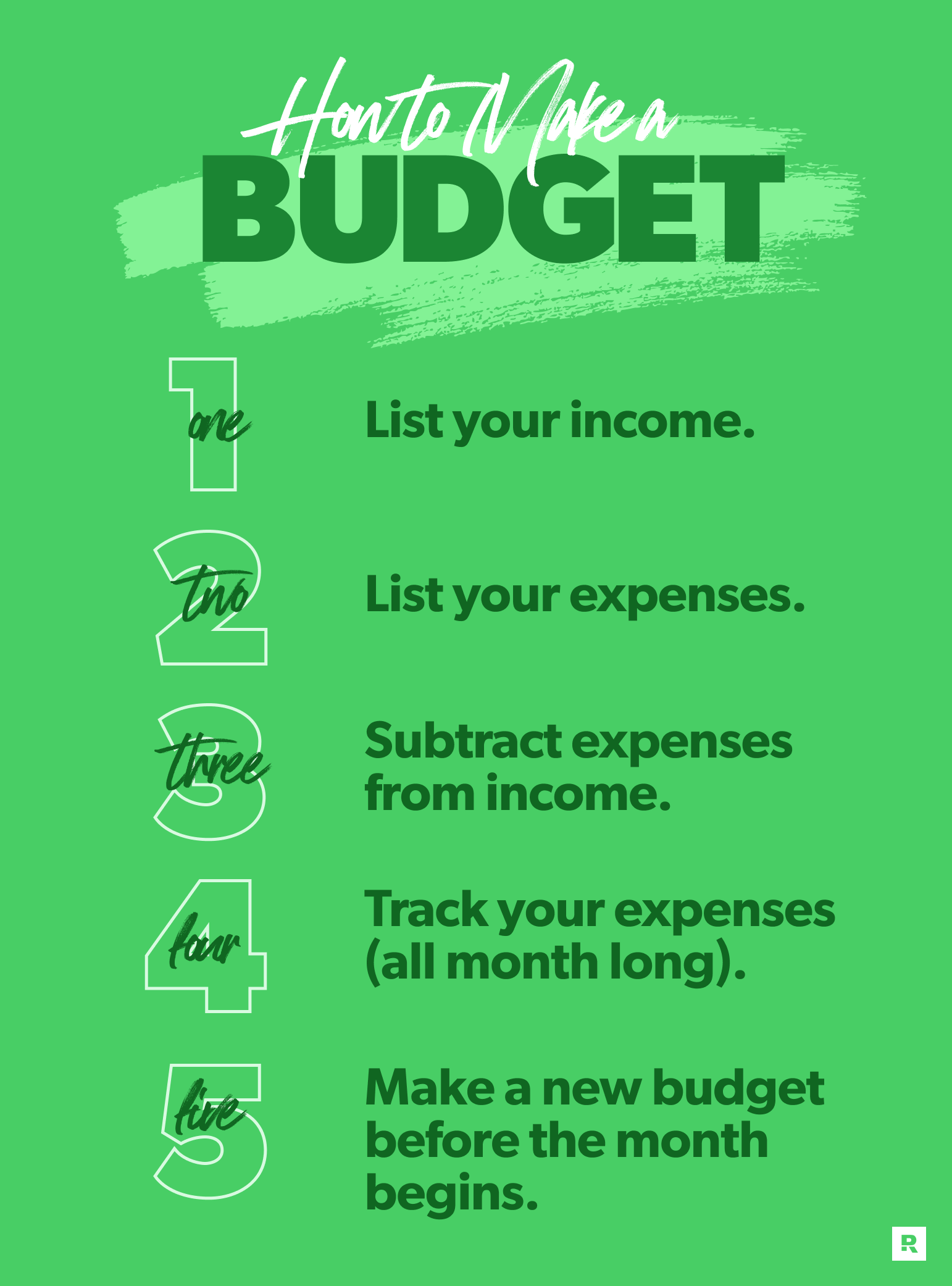

Steps to Create a Personal Budget

1. Gather Financial Information

Start the budgeting process by collecting all relevant financial data. This includes your income sources, regular expenses, and any additional expenditures. Bank statements, pay stubs, and bills will be crucial in this phase. Knowing your exact income and expenses helps establish a reliable foundation for your budget[5][7].

2. Calculate Income

Next, determine your total monthly income. This figure should represent your net income—what you take home after taxes and other deductions. Be sure to include any side income, freelance payments, or bonuses. If your income fluctuates, consider an average from past months to get a realistic view of what you can expect[3][7].

3. List Your Expenses

Identify all your expenses and categorize them into fixed, variable, and discretionary expenses:

Fixed Expenses: These are costs that remain constant each month, such as rent, mortgage, insurance, and car payments.

Variable Expenses: These are expenses that can change month-to-month, like groceries, fuel, and entertainment.

Discretionary Expenses: These are non-essential costs, such as dining out, subscriptions, and hobbies[2][9].

Accurate expense tracking is crucial. Review past statements to find exact figures or averages for each expense category[4][8].

4. Create Spending Categories

Organize your expenses into budget categories. A popular approach is to use the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment[6][9]. This framework can help maintain a balanced budget while also allowing for flexibility.

5. Subtract Expenses From Income

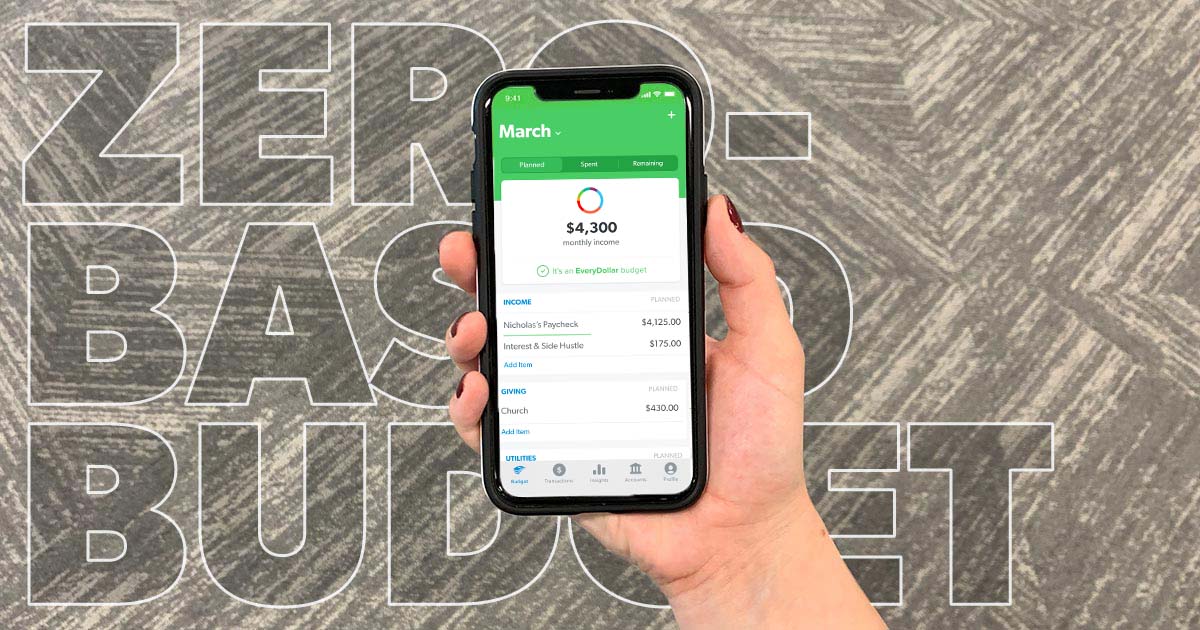

Once you have a complete picture of your income and expenses, subtract the total expenses from your income. Ideally, you should aim for a zero-based budget, where every dollar has a designated purpose, whether it’s for spending, saving, or investing[1][8]. If your expenses exceed your income, you will need to make cuts to non-essential spending categories[3].

6. Implement and Adjust Your Budget

With your budget in place, it’s time to implement it in your daily life. Track your spending regularly to ensure you’re staying within limits. If you overspend in a category, adjust other expenses accordingly to maintain balance. Flexibility is key—be prepared to analyze and tweak your budget as needed to adapt to changing circumstances[2][3][7].

7. Review Regularly

Budgeting is not a one-time task. Schedule regular reviews—monthly is ideal—to evaluate your financial progress, adjust for changes in income or expenses, and set new financial goals[8][9]. This helps in reinforcing good financial habits and keeping unfavorable spending trends in check.

Tips for Sticking to Your Budget

Set Clear Goals: Understanding why you are budgeting—whether it's saving for a vacation, building an emergency fund, or paying off debt—will keep you motivated.

Stay Accountable: Whether with a partner, spouse, or a friend, accountability can help you stick to your budget. Discuss your financial goals and progress regularly[9].

Use Tools and Apps: Consider utilizing budgeting tools and apps like EveryDollar or Mint to simplify the process. These platforms can make tracking expenses and managing your budget easier and more efficient[6].

Conclusion

Creating a personal budget may seem daunting, but with a structured approach, you can achieve financial awareness and control. By gathering financial information, calculating your income, and categorizing your expenses, you can craft a budget that not only meets your needs but supports your long-term financial goals. Remember, the effectiveness of a budget lies in its implementation and consistent review, so stay engaged with your financial health for lasting success.

Get more accurate answers with Super Pandi, upload files, personalized discovery feed, save searches and contribute to the PandiPedia.

Let's look at alternatives:

- Modify the query.

- Start a new thread.

- Remove sources (if manually added).